R45 Monthly Bank Fee Hike: On August 1st, South African bank users will face a notable change in their monthly expenses as banks across the country implement a R45 increase in monthly fees. This adjustment is set to affect millions of users who rely on banking services for their daily financial transactions. For many, this rise in costs may come as a surprise, creating a ripple effect on personal budgets and financial planning. Understanding the reasons behind this fee hike and its potential impact on consumers is crucial for navigating these changes effectively. As banks cite operational costs and inflation as primary factors, users must prepare for how this adjustment will influence their financial landscape.

Understanding the August 1st R45 Monthly Bank Fee Increase

As we approach August 1st, many South Africans are bracing for the announced R45 increase in monthly banking fees. This change is part of a broader trend where financial institutions are adjusting their fee structures to align with rising operational costs and inflationary pressures. For millions of users, this fee hike can have significant implications, particularly for those on tight budgets or fixed incomes. The increase is likely to affect various banking services, including savings accounts, checking accounts, and even certain transaction fees. Understanding the specifics of these changes can help consumers better manage their finances and explore potential alternatives to mitigate the impact.

| Service | Old Fee | New Fee | Difference | Percentage Increase |

|---|---|---|---|---|

| Savings Account | R60 | R105 | R45 | 75% |

| Checking Account | R80 | R125 | R45 | 56.25% |

| Transaction Fees | R10 per transaction | R15 per transaction | R5 | 50% |

Impact of the Fee Hike on South African Consumers

The R45 monthly fee increase is poised to impact South African consumers in various ways. For individuals and families who meticulously budget their expenses, an additional R45 monthly expenditure could mean cutting back on other essentials. This fee adjustment may also prompt users to reassess their banking choices, possibly considering institutions with more competitive fee structures. The increase could disproportionately affect students, pensioners, and low-income earners who may already be struggling with the current cost of living. As consumers navigate these changes, it’s essential to consider the broader economic context and seek ways to optimize financial management.

- Review your current banking package and compare it with others.

- Consider switching to a bank with lower fees if possible.

- Explore digital banking options that might offer reduced charges.

- Utilize financial planning tools to accommodate the new expense.

- Stay informed about any future changes in banking fees or policies.

Reasons Behind the R45 Monthly Bank Fee Hike

Several factors contribute to the decision of banks to implement the R45 monthly fee hike. Primarily, financial institutions cite rising operational costs as a significant driver. With inflation affecting various sectors, banks are under pressure to maintain profitability while still providing comprehensive services. Additionally, advancements in technology and security measures have increased costs for banks, which are often passed down to consumers in the form of higher fees. Understanding these underlying reasons can help consumers make informed decisions about their banking needs and explore opportunities to minimize the impact on their finances.

- Increased operational costs due to inflation.

- Investment in technology and security upgrades.

- Regulatory compliance costs.

- Global economic pressures affecting the banking sector.

Alternatives to Mitigate the Impact of Banking Fee Increases

As South African consumers face the prospect of higher banking fees, exploring alternatives to mitigate the impact becomes essential. One potential option is to consider digital banking platforms, which often offer more competitive fee structures and additional flexibility. Consumers can also look into consolidating their accounts to reduce the number of fees incurred monthly. Another strategy is to actively engage with their current bank to negotiate better terms or explore account upgrades that could offer more value for the fees paid. By taking these proactive steps, consumers can better manage their financial resources and lessen the burden of increased banking fees.

| Alternative | Potential Benefit | Notes |

|---|---|---|

| Digital Banking | Lower fees | Check for service availability |

| Account Consolidation | Reduced fee frequency | May require account restructuring |

| Negotiating Fees | Better terms | Depends on customer loyalty |

| Account Upgrades | More value for fees | Review terms and conditions |

Preparing for Future Financial Adjustments

Preparing for future financial adjustments is crucial in the dynamic economic landscape of South Africa. As consumers adapt to the R45 monthly bank fee hike, it’s vital to remain vigilant about potential future changes in banking and other financial sectors. Regularly reviewing financial statements and staying informed about economic trends can empower individuals to make proactive adjustments. Additionally, fostering a habit of saving and investing can provide a buffer against unforeseen financial challenges. By cultivating financial literacy and resilience, South Africans can navigate the complexities of banking fees and broader economic shifts more effectively.

- Stay informed about banking policies and changes.

- Regularly review financial statements and budgets.

- Consider financial literacy courses.

- Explore investment opportunities for additional income.

FAQ: Addressing Concerns About the R45 Monthly Fee Increase

Why are banks increasing monthly fees?

Banks are increasing fees to cover rising operational costs, inflation, and investments in technology and security.

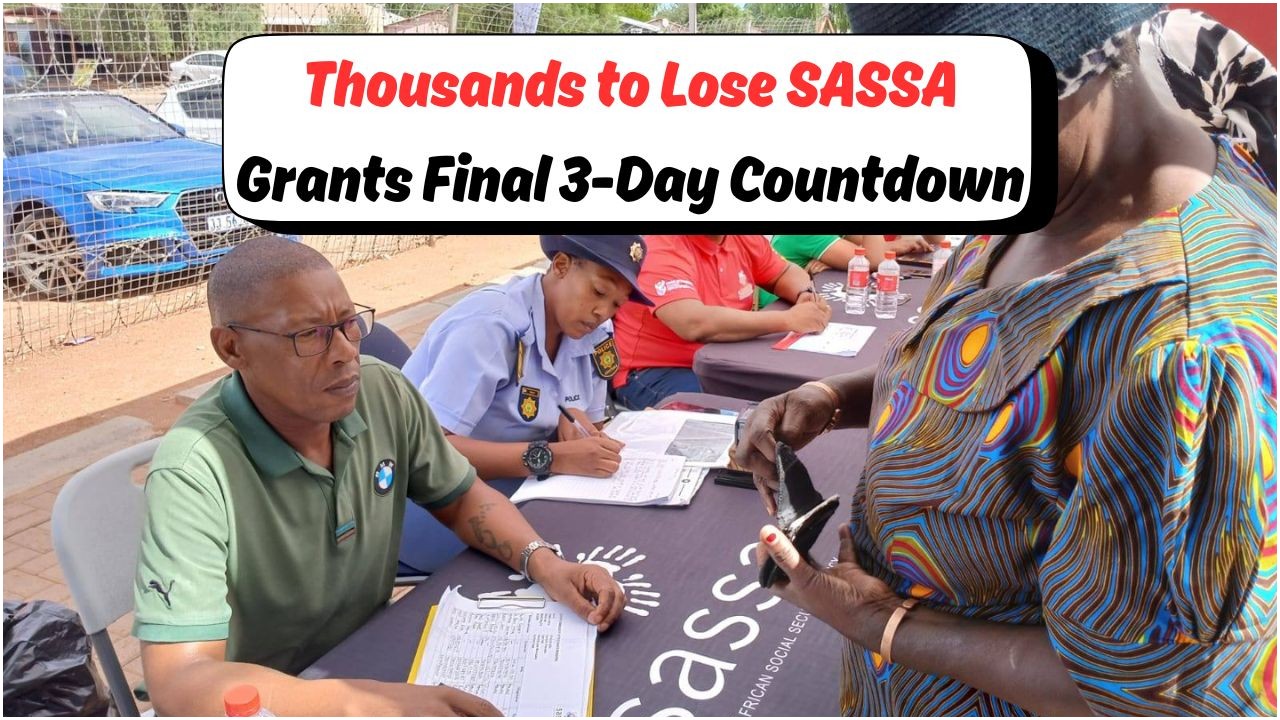

Urgent Alert: Update Your SASSA Documents in 3 Days to Prevent Grant Suspension on 27 July!

Urgent Alert: Update Your SASSA Documents in 3 Days to Prevent Grant Suspension on 27 July!

Who will be most affected by the fee hike?

Students, pensioners, and low-income earners may feel the impact more acutely.

What can consumers do to manage increased fees?

Consumers can compare banking packages, consider digital banking options, and negotiate better terms with their banks.

Are there any banks offering lower fees?

Some digital banks and smaller institutions may offer more competitive fee structures; it’s worth comparing options.

Is this fee increase permanent?

Fee structures can change over time, so staying informed about future adjustments is important.